Published: 28 January 2026

Financial fraud, disputes, and misconduct can seriously damage businesses — financially and reputationally. When numbers don’t add up, forensic accounting steps in.

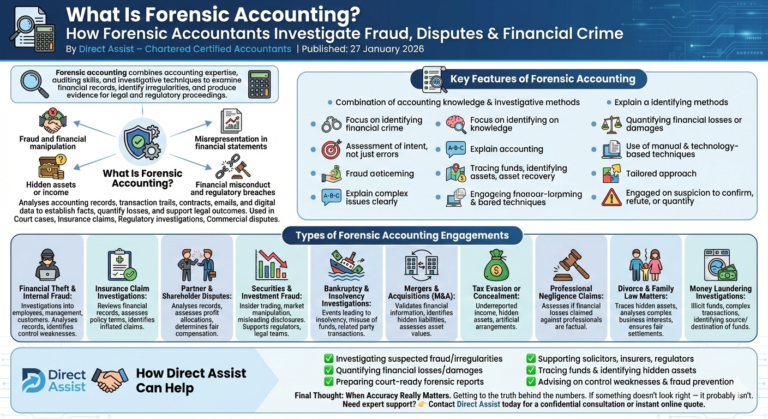

Forensic accounting combines accounting expertise, auditing skills, and investigative techniques to examine financial records in detail, identify irregularities, and produce evidence suitable for legal and regulatory proceedings.

At Direct Assist, we provide forensic accounting support to businesses, legal advisers, and individuals where clarity, accuracy, and defensible evidence are essential.

Forensic accounting involves the systematic investigation of financial information to uncover:

Fraud and financial manipulation

Misrepresentation in financial statements

Hidden assets or income

Financial misconduct and regulatory breaches

Forensic accountants analyse accounting records, transaction trails, contracts, emails, and digital data to establish facts, quantify losses, and support legal outcomes.

Their work is commonly used in:

Court cases and litigation

Insurance claims

Regulatory investigations

Commercial disputes

Forensic accounting is not routine bookkeeping or audit work. Its defining features include:

A combination of accounting knowledge and investigative methods

Focus on identifying whether a financial crime has occurred

Assessment of intent, not just errors

Ability to explain complex financial issues clearly to courts, lawyers, and regulators

Tracing funds, identifying assets, and assisting with asset recovery

Quantifying financial losses or damages

Use of both manual and technology-based investigation techniques

Tailored approach — no two investigations are the same

Forensic accountants are typically engaged once a suspicion already exists, and their role is to confirm, refute, or quantify the issue.

Forensic accountants may be involved in a wide range of cases, often linked to legal or regulatory proceedings.

Investigations into fraud committed by:

Employees

Management

Customers or external parties

Forensic accountants analyse records, identify control weaknesses, and report findings to management or authorities.

In cases of suspicious or complex claims, forensic accountants:

Review financial records supporting the claim

Assess whether claims meet policy terms

Identify inflated or duplicate claims

This is common in business interruption and loss-of-profit claims.

When disputes arise between business partners or shareholders, forensic accountants:

Analyse financial records

Assess profit allocations

Determine fair compensation or settlement values

Under the fair value model, investment property is measured at fair value at each reporting date, in line with IFRS 13 – Fair Value Measurement.

Key features:

No depreciation is charged

No impairment testing is required

All fair value movements (upward and downward) are recognised directly in profit or loss

This model can significantly increase profit volatility — but provides greater transparency for investors.

Forensic accountants investigate:

The events leading up to insolvency

Misuse of funds

Transactions with related parties

Lenders often engage forensic specialists to understand whether insolvency resulted from mismanagement, fraud, or genuine commercial failure.

During acquisitions or mergers, forensic accounting helps to:

Validate financial information

Identify hidden liabilities or risks

Assess true asset values and returns

This provides buyers with confidence before completing a transaction.

Forensic accountants assist in identifying:

Underreported income

Hidden assets

Artificial arrangements designed to reduce tax

Their findings are often used in tax investigations and disputes.

In cases involving alleged negligence by:

Accountants

Lawyers

Other professionals

Forensic accountants assess whether financial losses claimed are factual and supported by evidence.

In divorce proceedings, forensic accountants help:

Trace hidden assets or income

Analyse complex business interests

Ensure fair financial settlements

Forensic accountants support investigations into:

Illicit funds passing through accounts

Complex transaction chains

Identifying the source and destination of funds

This work is often linked to regulatory or criminal investigations.

At Direct Assist, our forensic accounting services focus on clarity, independence, and credibility.

We support clients by:

✅ Investigating suspected fraud or financial irregularities

✅ Quantifying financial losses and damages

✅ Preparing court-ready forensic reports

✅ Supporting solicitors, insurers, and regulators

✅ Tracing funds and identifying hidden assets

✅ Advising on control weaknesses and fraud prevention

Forensic accounting is about getting to the truth behind the numbers. Whether you’re dealing with fraud, a dispute, or a high-stakes investigation, having independent financial expertise can make all the difference.

If something doesn’t look right — it probably isn’t.

👉 Contact Direct Assist today for a confidential consultation or instant online quote.

Direct Assist – Chartered Certified Accountants providing clarity when it matters most.

Excellent rating

Based on 84 reviews

(0203) 633 2018

info@directassistaccountants.co.uk

Provide your details and one of our experts will be in touch.