- info@directassistaccountants.co.uk

- Mon - Fri: 9:00 - 18:30

Need A Free Consultation? Make An Appointment

Need A Free Consultation? Make An Appointment

Stress-Free Statutory Accounts for Slough Businesses

Direct Assist Accountants: Precision Year-End Compliance for Companies House & HMRC

Accurate, Timely & Fully Compliant Reporting

Every limited company in the UK is legally required to prepare Statutory Year-End Accounts — and at Direct Assist Accountants, we ensure yours are submitted accurately, on time, and in full compliance with Companies House and HMRC regulations.

Our experienced team, based in Slough, helps businesses of all sizes close their financial year with confidence, clarity, and peace of mind.

Statutory accounts (also known as annual accounts) are a summary of your company’s financial activity over the year. They show your company’s performance and must be filed with:

Companies House

HMRC (alongside your Corporation Tax return)

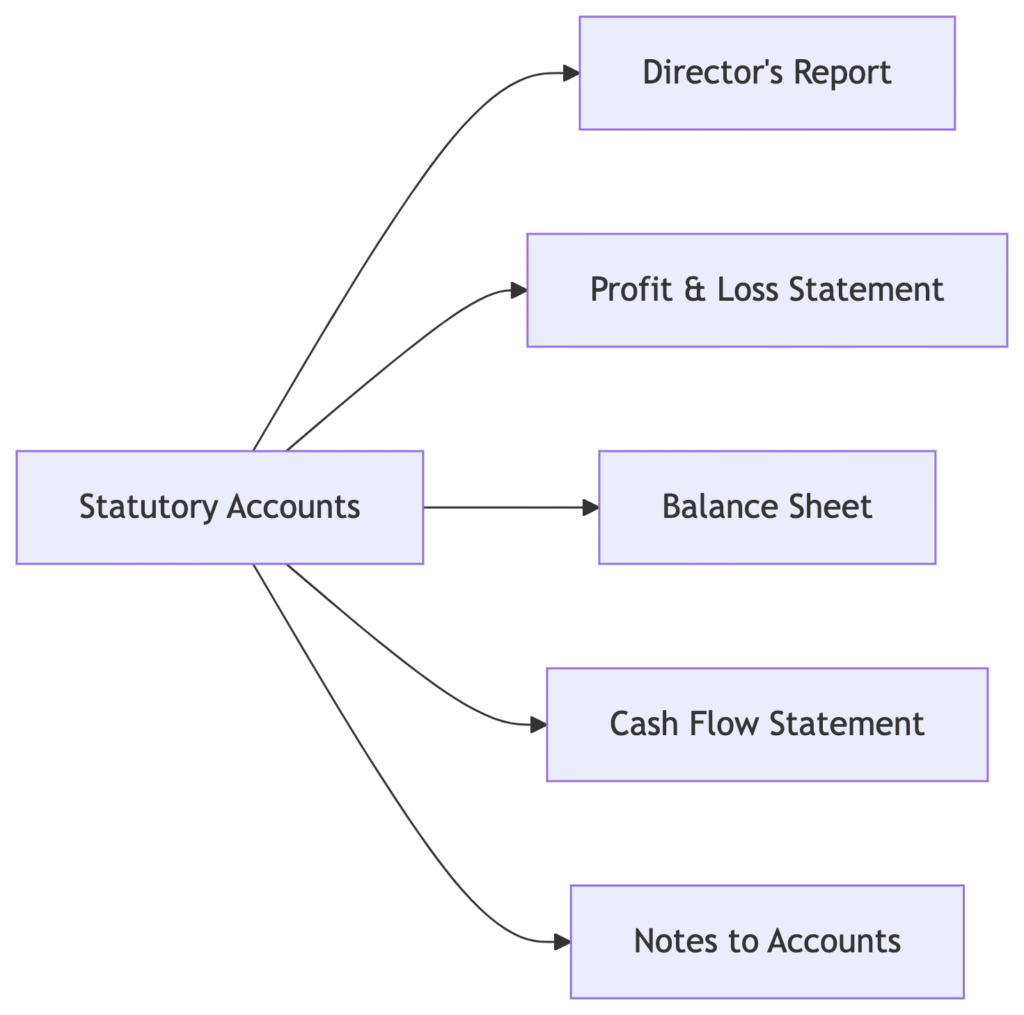

They include key documents such as:

Balance Sheet

Profit & Loss Account

Notes to the Accounts

Director’s Report (for larger companies)

Avoid Costly Consequences

⚠️ Late Filing Penalties:

£150 (1 month late) → £1,500 (6+ months late)

Director prosecution risk

⚠️ Rejection Risks:

37% of first-time filings are rejected (Companies House data)

Common errors: Discrepancies in P&L/Balance Sheet, missing disclosures

⚠️ Tax Implications:

Incorrect accounts lead to overpaid tax or HMRC investigations

📞 Get your year-end accounts done right — first time, every time.

Contact Direct Assist Accountants today for a free consultation or quote.

(0203) 633 2018

info@directassistaccountants.co.uk

Excellent rating

Based on 76 reviews

2025 Direct Assist Accountants Ltd. All rights reserved.