Published: 30 February 2026

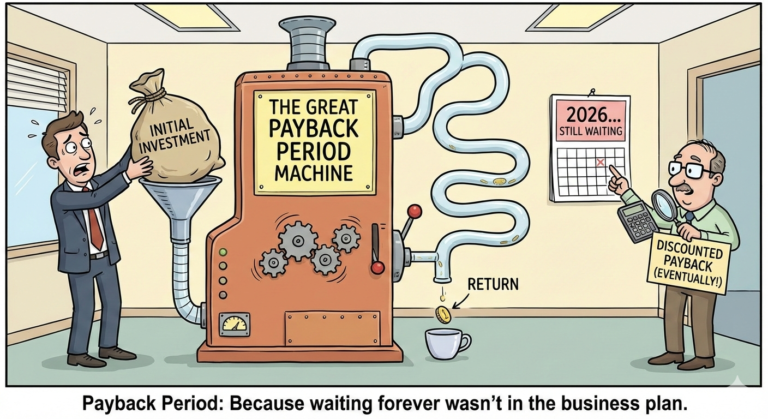

When businesses evaluate new projects, equipment purchases, or expansion plans, one key question always comes first:

How quickly will we recover our investment?

The payback period is one of the simplest and most widely used capital budgeting tools to answer that question. In this guide, we explain how the payback period works, how it differs from the discounted payback period, and when each method is most useful.

The payback period measures the time required for a project’s cash inflows to recover its initial investment.

In simple terms, it tells you how long it takes before an investment “pays for itself”.

The general rule is:

The shorter the payback period, the lower the investment risk.

Projects that recover cash quickly are usually considered less risky than those with long recovery periods.

There are two commonly used methods:

Simple Payback Period

Discounted Payback Period

Payback Period = Initial Investment ÷ Annual Net Cash Inflow

This method assumes cash inflows are even each year and does not account for the time value of money.

A company plans a project requiring an initial investment of £154 million.

The project is expected to generate £35 million per year for seven years.

Payback Period = £154m ÷ £35m = 4.4 years

This means the business recovers its original investment in just over four years.

The main limitation of the simple payback period is that it ignores the time value of money.

To address this, the discounted payback period method is used.

The discounted payback period calculates the time required for the present value of future cash inflows to recover the initial investment.

In practice:

Each year’s cash inflow is discounted to present value

Discounted cash flows are accumulated

The payback point is reached when cumulative discounted inflows equal the initial investment

Unlike the simple payback method, this approach recognises that money today is worth more than money in the future.

| Area | Simple Payback Period | Discounted Payback Period |

|---|---|---|

| Time value of money | Ignored | Included |

| Complexity | Very simple | More accurate but complex |

| Cash flow basis | Nominal cash flows | Discounted cash flows |

| Risk assessment | Basic | More realistic |

Because of discounting, the two methods often produce different results.

Businesses often use online financial calculators or spreadsheet models to speed up calculations, especially when cash flows vary from year to year.

However, understanding the logic behind the calculation remains essential for decision-making.

There is no universal benchmark for a good payback period — it depends on:

Industry norms

Business risk appetite

Project size and uncertainty

That said, shorter payback periods are generally preferred, as they reduce exposure to long-term risk and uncertainty.

The payback period is widely used because it is:

Easy to understand

Quick to calculate

Helpful for comparing investment options

Useful for assessing liquidity and risk

For many businesses, it serves as a first screening tool before applying more advanced techniques.

These concepts are often confused but serve different purposes:

Break-even point identifies the level of revenue required to achieve no profit and no loss

Payback period measures how long it takes to recover the initial investment

Both are useful, but they answer different financial questions.

Despite its simplicity, the payback method has important drawbacks:

Ignores cash flows after the payback point

Simple payback ignores the time value of money

Does not measure overall profitability

This is why it should never be used in isolation.

The payback period is one of the most practical tools for early-stage investment appraisal. It helps businesses assess risk, liquidity, and recovery speed.

However:

Use simple payback for quick screening

Use discounted payback for more realistic analysis

Combine with other methods such as NPV and IRR for sound decision-making

At Direct Assist, we help businesses evaluate investments with clarity — not just quick numbers.

👉 Contact Direct Assist today for a free consultation or instant online quote.

Direct Assist – Chartered Certified Accountants helping businesses make smarter financial decisions.

Excellent rating

Based on 84 reviews

(0203) 633 2018

info@directassistaccountants.co.uk

Provide your details and one of our experts will be in touch.