Published: 14 January 2026

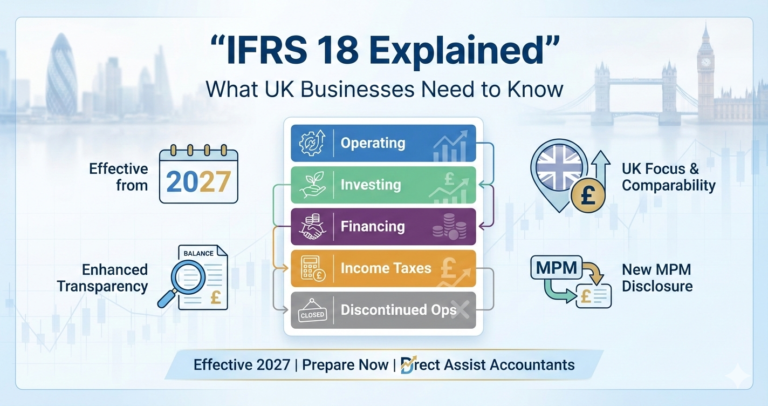

In April 2024, the International Accounting Standards Board (IASB) launched IFRS 18 – Presentation and Disclosure in Financial Statements, a major update that replaces the long-standing IAS 1. While it won’t take effect until 1 January 2027, forward-thinking UK businesses — especially those preparing for growth, investment, or eventual public listing — should start paying attention now.

At Direct Assist Accountants, we help business owners cut through accounting complexity. So let’s break down what IFRS 18 really means — and why it matters, even if you’re not yet required to use it.

The biggest shift in IFRS 18 is how companies must present their statement of profit or loss (also known as the income statement). Instead of one long list of revenues and expenses, income and costs must now be grouped into five clear categories:

This structure makes it easier for investors, lenders, and even your own management team to see what’s driving performance — and where risks or opportunities lie.

💡 Example: If your “operating profit” is strong but “financing costs” are rising, you know your core business is healthy — but your debt strategy may need review.

IFRS 18 also introduces two mandatory subtotals in the profit & loss statement:

These act like “waypoints” — helping users assess profitability at key stages, without getting lost in the details.

Plus, vague labels like “other income” or “miscellaneous expenses” are discouraged. The goal? Transparency over convenience.

Many companies use internal metrics like “adjusted EBITDA” or “core earnings” to tell their story. Under IFRS 18, these Management-Defined Performance Measures (MPMs) must now be:

This stops misleading headlines like “Company X reports £5M profit!” when the actual IFRS profit is much lower. It’s about honest storytelling — backed by real numbers.

📌 Note: This applies to interim reports too (thanks to updates to IAS 34), so quarterly updates must follow the same rules.

Technically, IFRS 18 applies to all entities that use IFRS — typically larger private companies, multinationals, or those planning an IPO.

But here’s the thing: even if you’re a UK limited company using FRS 102, these changes matter. Why?

If you’re scaling your business, seeking funding, or considering a sale, adopting IFRS 18 principles early can give you a competitive edge.

IFRS 18 doesn’t exist in isolation. It also affects:

This creates a more cohesive financial story across all statements.

That gives you over 18 months to prepare — but don’t wait until the last minute.

At Direct Assist, we don’t just ensure compliance — we help you use financial reporting as a strategic tool.

As IFRS 18 approaches, we can support you by:

✅ Reviewing your current profit & loss structure and identifying gaps

✅ Helping you define meaningful, compliant MPMs (if needed)

✅ Upgrading your FreeAgent or Xero setup to track data by category (operating, investing, financing)

✅ Training your team on the new presentation requirements

✅ Ensuring your disclosures meet both IFRS and HMRC expectations

Because great financial reporting isn’t just about rules — it’s about clarity, confidence, and credibility.

You don’t need to overhaul your accounts overnight. But ask yourself:

If not, now’s the time to build better foundations.

With smart systems, clear categorisation, and proactive support from your accountant, you’ll be ready — not just for IFRS 18, but for whatever comes next.

Want to future-proof your financial reporting?

👉 Get in touch today for a free consultation or instant online quote.

Direct Assist – Chartered Certified Accountants helping UK businesses grow with clarity.

(0203) 633 2018

info@directassistaccountants.co.uk

Excellent rating

Based on 84 reviews

Provide your details and one of our experts will be in touch.