Published: 20 February 2026

Taking time off as a small business owner can feel risky. When you’re self-employed or running a limited company, stepping away from work often means stepping away from income. Unlike employees who continue to receive paid annual leave, business owners must plan carefully before taking extended time off.

However, rest isn’t optional it’s essential.

Without proper downtime, burnout becomes a serious risk, particularly for sole traders and company directors managing client work alongside bookkeeping, tax deadlines, and daily operations.

The good news? With proper financial planning and structured cash flow management, taking time off doesn’t have to threaten your business stability.

At Direct Assist Accountants, we regularly help clients plan ahead so they can take time away confidently, knowing their finances remain under control.

Let’s look at what really happens financially when you step away and how to prepare properly.

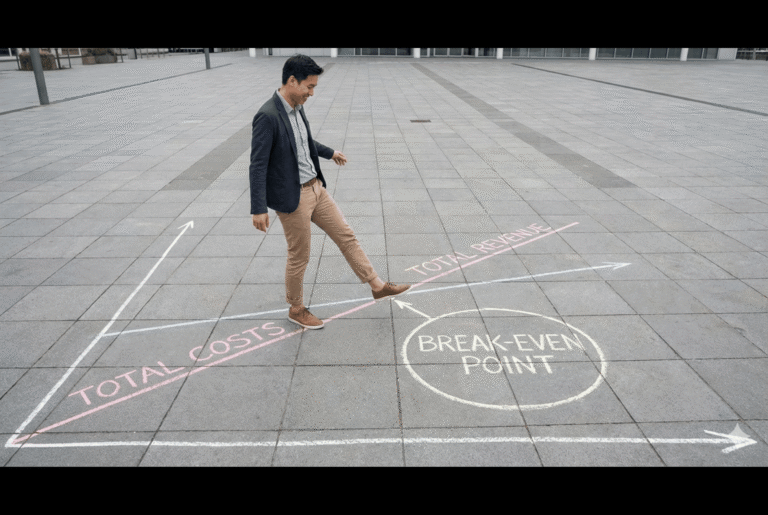

Your break-even point is the amount of revenue your business needs to generate in order to cover all its costs. These costs typically include:

Fixed costs, such as:

Insurance

Salaries

Loan repayments

Software subscriptions

Rent or office expenses

Variable costs, such as:

Marketing

Equipment

Operational expenses

At the break-even point, your business is not making a profit but also not making a loss.

Knowing this figure helps you answer important business questions such as:

How much revenue do you need each month to stay financially stable?

Are your current pricing strategies sufficient?

Can certain expenses be reduced?

Do you have a buffer for slower months?

Are you building financial reserves for the future?

Understanding your break-even point gives you better control over your finances and helps remove guesswork from your business decisions.

One of the most common mistakes small business owners make is focusing only on revenue (turnover) rather than profit.

While increasing revenue is positive, it doesn’t necessarily mean your business is financially healthy. If your costs increase faster than your income, your break-even point rises and your business may actually become less profitable.

Even small increases in expenses can impact profitability over time. Monitoring both revenue and costs ensures that business growth translates into long-term financial stability.

Your break-even point is not fixed. It changes as your business evolves.

Several factors can affect it, including:

Changes in tax or National Insurance contributions

Increased operating costs

Hiring employees

Seasonal fluctuations in income

Economic conditions

Business expansion

For many self-employed professionals and small businesses, income can vary significantly throughout the year. This makes it important to review your break-even point regularly.

Monitoring it monthly helps you:

Prepare for slower periods

Manage cash flow effectively

Adjust your pricing

Control expenses

Maintain profitability

Many business owners rely on their bank balance as an indicator of financial health, but this can be misleading.

Your bank balance only reflects the funds available at a specific moment. It does not account for:

Upcoming tax liabilities

Pending bills

Seasonal income changes

Future expenses

This can create a false sense of security. Without understanding your break-even point, unexpected costs can quickly push your business into financial difficulty.

Having clear financial visibility helps prevent cash flow problems and allows you to plan ahead more effectively.

Costs can sometimes be overlooked, particularly smaller or variable expenses that gradually increase over time.

Examples include:

Subscription services

Software tools

Small recurring business expenses

Seasonal operational costs

When these costs are not properly tracked, they can increase your break-even point without you realizing it.

Keeping accurate records of all expenses ensures you have a realistic understanding of how much revenue you need to generate each month to remain profitable.

Using modern accounting software can make managing your finances much easier.

Popular tools like FreeAgent and Xero allow businesses to:

Track income and expenses automatically

Import bank transactions

Generate financial reports

Monitor cash flow

Review profit and loss statements

Analyse financial performance

These tools help you calculate and monitor your break-even point more accurately. They also allow you to review historical data and account for seasonal trends in your business.

At Direct Assist Accountants Ltd, we do more than just prepare accounts and manage tax returns. We help businesses understand their financial position and plan for long-term success.

Our services include:

Financial planning and advisory

Break-even and profitability analysis

Cash flow forecasting

Tax planning and compliance

Cloud accounting setup and support

Business growth guidance

We support sole traders, contractors, startups, and limited companies to ensure they have the financial clarity needed to make confident decisions.

With the right financial insights and professional support, you can focus on growing your business while staying financially secure.

👉 Contact Direct Assist Accountants today for a free consultation or instant online quote.

Direct Assist Chartered Certified Accountants helping businesses make smarter financial decisions.

Excellent rating

Based on 84 reviews

(0203) 633 2018

info@directassistaccountants.co.uk

Provide your details and one of our experts will be in touch.